Our History

How we got started

ClaimStar Adjusting was founded to address a critical gap in the insurance process: while insurance companies have their own adjusters, property owners often lack proper representation. Peter Gaetano, the founder, began his career as an independent adjuster, working with insurance companies across Florida and nearby states. Witnessing this imbalance, he obtained his public adjusting license, opened an LLC, and quickly signed his first client. Demand for fair claim settlements in the DC, Northern Virginia, and Maryland areas grew rapidly, prompting Peter to expand his team to manage the influx of cases. Since then, ClaimStar has serviced thousands of claims, helping property owners secure fair settlements and restore their properties with confidence.

Our Services

Fire Claims

Fire damage can be devastating to your home or business, but you don’t have to face it alone. Our public adjusters are here to help you recover the maximum amount for your fire damage claim.

Fire damage isn’t always about flames consuming a property. Often, the aftermath involves less obvious but equally significant issues, like the lingering effects of smoke or the water used in extinguishing efforts. These elements can lead to hidden structural concerns, damaged belongings, and unexpected cleanup costs, all of which may qualify for a claim.

Water Claims

Water damage can affect your property in ways that are both immediate and long-term. From a burst pipe to flooding caused by heavy rainfall, the destruction can extend beyond what’s visible on the surface. Issues like mold growth, structural weakening, and electrical system damage may not always be obvious at first. Unfortunately, insurance companies often focus on the most apparent damage, leaving hidden problems unaddressed.

A public adjuster can ensure every aspect of water damage is documented and included in your claim. By leveraging their expertise, you can recover compensation for not just visible damage but also for secondary issues that might emerge later, like mold remediation and foundational repairs. Their focus is on your best interests—not the insurance company’s bottom line.

Hurricane Claims

Hurricanes bring a combination of destructive forces, including high winds, torrential rain, and storm surges, making them one of the most devastating natural disasters. The impact can range from structural damage to flooding, as well as long-term issues like mold and compromised foundations. Insurance companies often prioritize quick settlements, which may not cover the full extent of the damage.

A public adjuster works to maximize your hurricane claim, ensuring that every aspect of the destruction—both seen and unseen—is accounted for. They’ll advocate for you, handling negotiations with your insurer and making sure your settlement reflects the true cost of restoring your property and peace of mind.

Wind / Tree Claims

The power of wind can leave a trail of destruction in its path. From shingles torn off roofs to fallen trees damaging structures, wind doesn’t need to be part of a storm to cause significant property issues. Even moderate winds can loosen siding, break windows, and create vulnerabilities that worsen over time.

Hiring a public adjuster means you’ll have a professional on your side to inspect your property thoroughly, identifying damage that insurance adjusters might overlook. They’ll help ensure you’re compensated not just for visible damage but also for potential repairs needed to restore your property fully and prevent future problems.

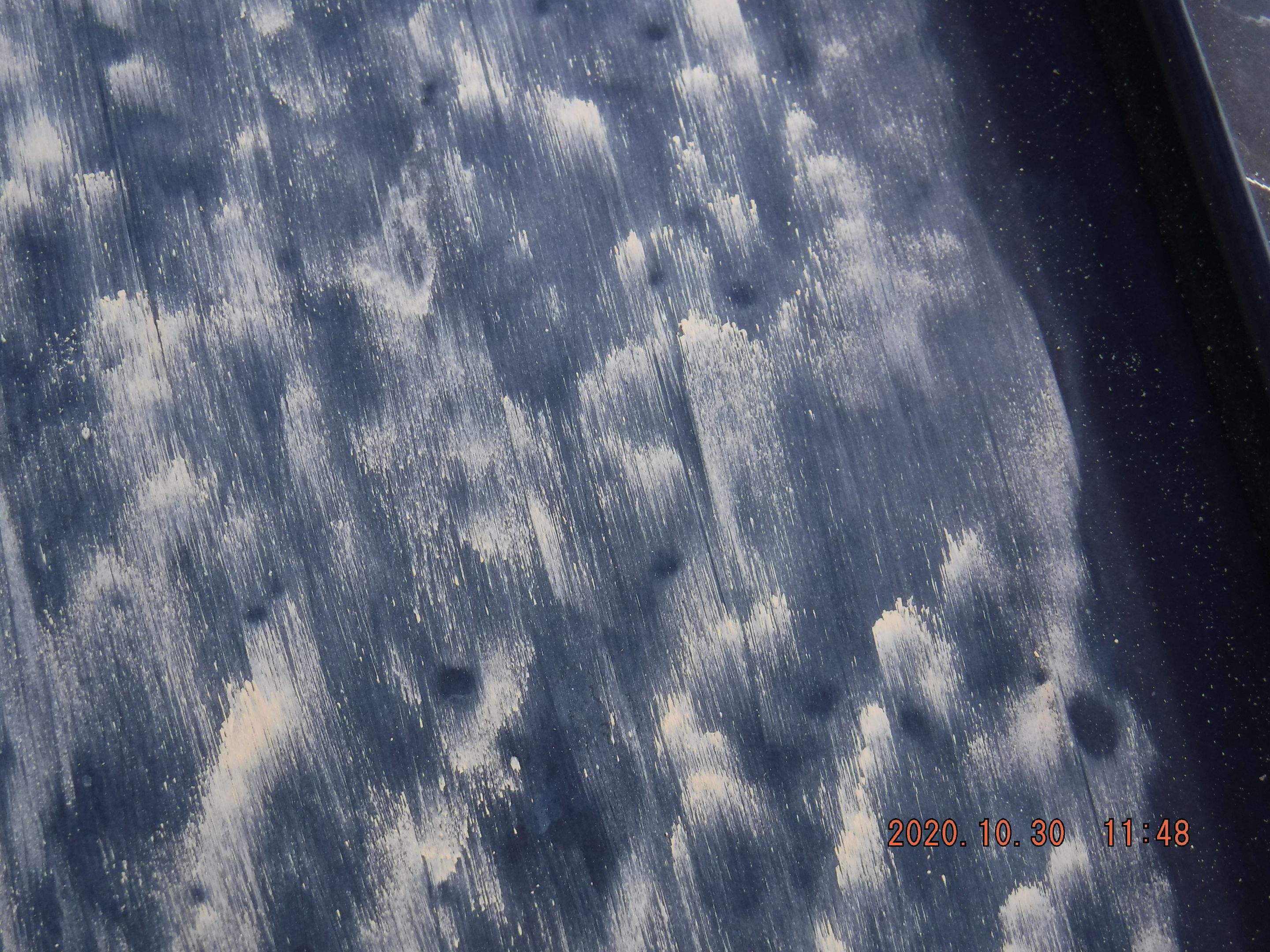

Hail Claims

Hail may seem like a fleeting weather event, but the damage it leaves behind can be substantial. From dented roofs and siding to broken windows, hail can weaken your property’s defenses, leaving it vulnerable to future problems like water damage. Small cracks caused by hail can grow over time, leading to leaks, rotting wood, and hidden structural issues.

With a public adjuster on your side, you won’t have to worry about missing any damage that could affect your property’s value. They’ll conduct a comprehensive inspection, document all hail-related issues, and negotiate with your insurance company to secure a settlement that covers both immediate repairs and preventative measures.

Ready to Get Started?

Contact us today for a free consultation and let us handle the stress of your insurance claim.

Request a Free ConsultationOur Claims Process

1

Initial Consultation

Homeowners contact us to discuss the damage to their property. We gather details, review the insurance policy, and determine if our services will be beneficial.

Objective: Understand the scope of the damage and policy coverage.

2

Agreement to Represent the Client

Once the homeowner decides to proceed, we sign a representation agreement, allowing us to work on their behalf.

Objective: Formalize our relationship and ensure we can negotiate the claim.

3

Damage Assessment and Documentation

We conduct a thorough inspection of the property, document the damage, and consult with specialists if necessary.

Objective: Collect comprehensive evidence to support the claim.

4

Review of Insurance Policy

We carefully review the policy to understand coverage limits, exclusions, and other terms.

Objective: Identify eligible reimbursements and potential issues in advance.

5

Filing the Claim with the Insurance Company

We submit the claim on behalf of the homeowner, including all necessary documentation and estimates.

Objective: Initiate the claims process correctly to avoid delays.

6

Negotiation with the Insurance Company

We review the settlement offer, compare it with our findings, and negotiate to maximize the payout.

Objective: Secure the most favorable settlement through expert negotiation.

7

Final Settlement and Claim Resolution

We finalize the settlement, ensuring it reflects the actual damages. If necessary, we appeal or take legal action.

Objective: Ensure full compensation for the homeowner.

8

Post-Settlement Support

We offer ongoing support for repair-related issues or follow-up concerns.

Objective: Provide peace of mind and satisfaction.

1

Initial Consultation

Homeowners contact us to discuss the damage to their property. We gather details, review the insurance policy, and determine if our services will be beneficial.

Objective: Understand the scope of the damage and policy coverage.

2

Agreement to Represent the Client

Once the homeowner decides to proceed, we sign a representation agreement, allowing us to work on their behalf.

Objective: Formalize our relationship and ensure we can negotiate the claim.

3

Damage Assessment and Documentation

We conduct a thorough inspection of the property, document the damage, and consult with specialists if necessary.

Objective: Collect comprehensive evidence to support the claim.

4

Review of Insurance Policy

We carefully review the policy to understand coverage limits, exclusions, and other terms.

Objective: Identify eligible reimbursements and potential issues in advance.

5

Filing the Claim with the Insurance Company

We submit the claim on behalf of the homeowner, including all necessary documentation and estimates.

Objective: Initiate the claims process correctly to avoid delays.

6

Negotiation with the Insurance Company

We review the settlement offer, compare it with our findings, and negotiate to maximize the payout.

Objective: Secure the most favorable settlement through expert negotiation.

7

Final Settlement and Claim Resolution

We finalize the settlement, ensuring it reflects the actual damages. If necessary, we appeal or take legal action.

Objective: Ensure full compensation for the homeowner.

8

Post-Settlement Support

We offer ongoing support for repair-related issues or follow-up concerns.

Objective: Provide peace of mind and satisfaction.

People who love our work

At ClaimStar, we aim to make the claims process smooth and stress-free while helping you secure the settlement you deserve. By focusing on your needs and advocating on your behalf, we strive to restore both your property and your peace of mind.

Used ClaimStar as my adjuster when getting a roof replacement due to weather damage. They informed me of the process from the beginning and were there ever step of the way with updates. My insurance company did not make the process easy at all, if not for ClaimStar i do not think I would have gotten a roof replacement. They offer an amazing service that I would suggest anyone who needs to make claims on home owners insurance first call ClaimStar! Thank you guys for everything!

01 Oct 2021

We highly recommend ClaimStar. They did an excellent job handling our water damage claim. Our insurance company dragged their feet but Peter helped to speed up the process. He was professional and he responded to our emails/calls promptly. ClaimStar advocated for us so that we were able to have enough money for restoration, repairs, and renovation. We did not have to worry about the insurance company trying to nickel-and-dime us. We are so thankful for all of their help.

01 Oct 2021

I had never used a public adjuster before, didn't know they existed. Now, I would never do another claim without one. Kevin was absolutely amazing. He handled ever aspect of the claim. The insurance company missed over $6,000 in repairs and Kevin not only discovered the missed items, but was able to get the insurance company to pay the extra amount with his detailed report and pictures. This was the first zero stress claim I ever experienced with an insurance company thanks to ClaimStar and Kevin. Their communication was outstanding. I definitely recommend!

01 Oct 2021

I definitely highly recommend ClaimStar. Peter was absolutely amazing and helped me tremendously through this whole process on getting my roof inspected professionally and properly with an engineer. Peter worked extremely hard with my insurance company to finally get the final approval on getting a new roof plus a lot more. Peter, Matt and Joseph are all amazing guys to talk to and deal with. You couldn’t ask for a better team.

01 Oct 2021

Our experience with ClaimStar has been excellent. The representative handled everything in a respectful, professional manor, and worked very congenially with our insurance company, Westfield. We were very pleased with the entire project.

01 Oct 2021

The Team

Peter Gaetano

Peter brings over 10 years of expertise in the public adjusting field and is a respected leader within the industry. Known for his strategic thinking and commitment to client success, Peter has successfully navigated countless claims to achieve optimal outcomes with a knack for turning seemingly impossible claims into success stories. His professional approach and ability to build trust have earned him a reputation as a steadfast advocate for policyholders.

Josh Phillips

Josh is a seasoned adjuster with a reputation for being fiercely dedicated to his clients. His attention to detail and ability to uncover hidden opportunities in claims make him a trusted advocate. When Josh isn’t negotiating with insurance companies, he’s likely spending time with family, riding his motor cycle, or modeling as Jesus in a Henry Wingate painting.

Kevin

Kevin is a dedicated and highly effective public adjuster, known for his unwavering commitment to advocating for clients. With a calm demeanor and a methodical approach, Kevin excels at navigating complex claims processes to secure fair outcomes. His kind nature, professional manners, and genuine empathy make him a trusted partner for policyholders during challenging times. A quiet but confident presence, Kevin’s ability to listen and connect ensures every client feels supported and valued.

Anthony Christi

Anthony is a personable and trustworthy public adjuster who approaches every claim with honesty and integrity. Dedicated to helping policyholders navigate the claims process, Anthony combines his expertise with a genuine commitment to securing the best possible outcomes for his clients. Outside of work, Anthony enjoys spending time with his young family and relaxing with a good cigar, embracing life’s simple pleasures while maintaining his dedication to professionalism.

Brian

Brian is a dependable and proactive member of the team, providing exceptional support to the public adjusters and ensuring seamless coordination throughout the claims process. Though new to the industry, Brian has quickly proven himself as a reliable resource, known for his thorough follow-up and willingness to assist wherever needed. His dedication and strong work ethic make him an invaluable part of the team, always focused on delivering the highest level of service to clients and colleagues alike.

Annalise Delaney

Annalise plays a vital role in supporting both Mike and Peter, stepping in wherever assistance is needed to ensure the team operates at its best. With a warm smile and a quiet confidence, Annalise works diligently behind the scenes while never hesitating to engage when the situation calls for it. Her reliability, attention to detail, and supportive nature make her an indispensable member of the team, always ready to contribute to the success of every claim.

Mike Mazarra

Mike is the backbone of the office, known for his no-nonsense approach and unwavering commitment to getting things done right. Whether he’s managing day-to-day operations or leading the claims assistants, Mike ensures everything stays on track and running smoothly. His military general mentality means he’s always focused on solutions—if things aren’t going well, you can trust Mike to step in and make it right. With his strong leadership and results-driven mindset, Mike sets the standard for professionalism and efficiency within the team.

Why Choose ClaimStar?

Experienced Experts

Detailed Inspections

Personalized Service

Transparent Process